Corporate Governance

Basic Stance

To remain deserving of the firm trust and confidence society has placed in it, Rengo's goal is timely and accurate information disclosure combined with sound and highly transparent management with the mission of solving social issues through packaging. In keeping with our fundamental philosophy whose essence is “The truth is in the workplace,” we are enhancing corporate governance by strengthening the current system of directors and Audit & Supervisory Board members while delegating authority and accelerating decision-making. In response to the Corporate Governance Code, we have disclosed our approaches to corporate governance in the form of a Corporate Governance Report to the Tokyo Stock Exchange. The most recent report was submitted on June 30, 2025. Considering the purpose of the Corporate Governance Code, we are continuing to work toward sustained growth for our company and improving our corporate value in the medium- to long-term.

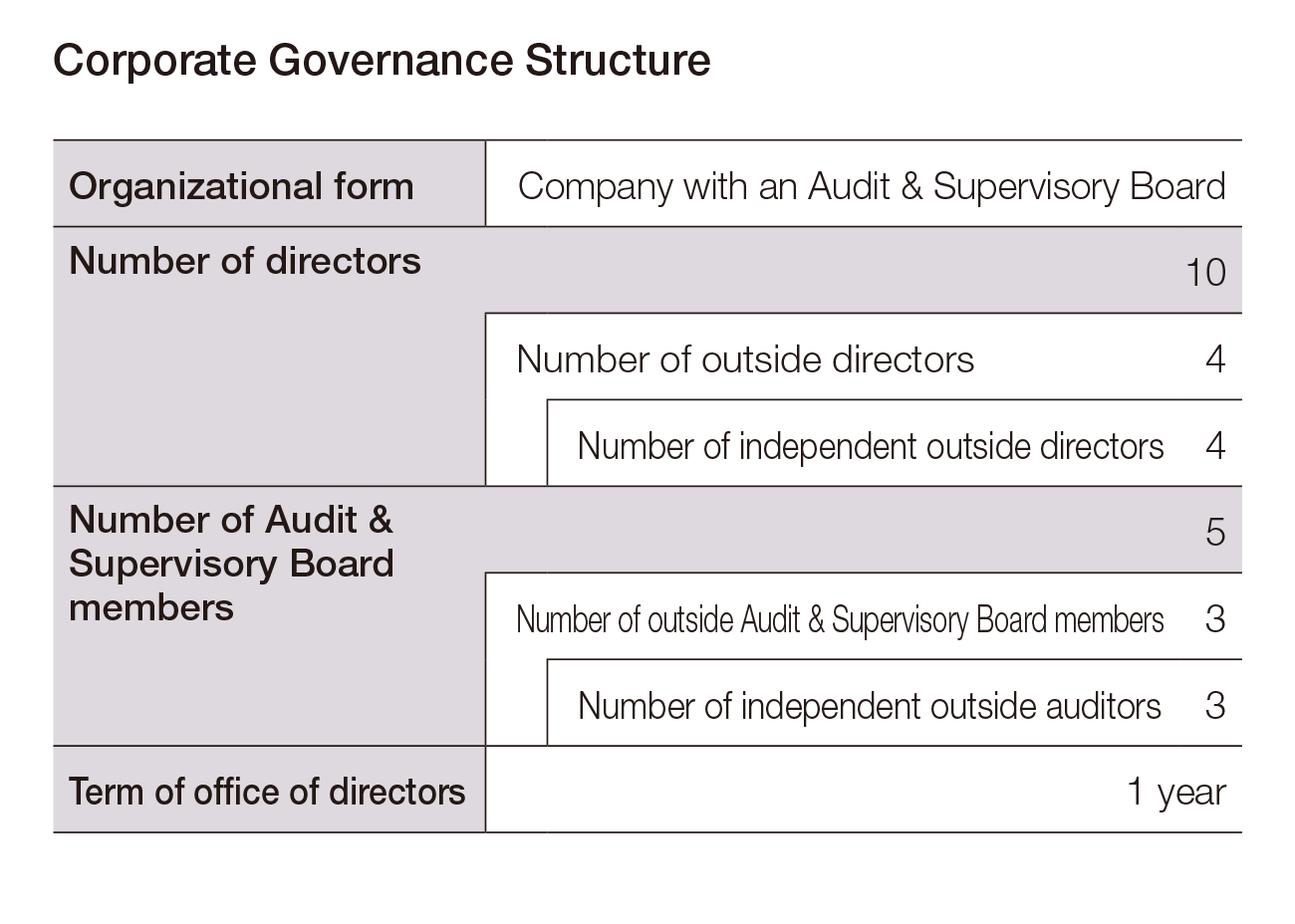

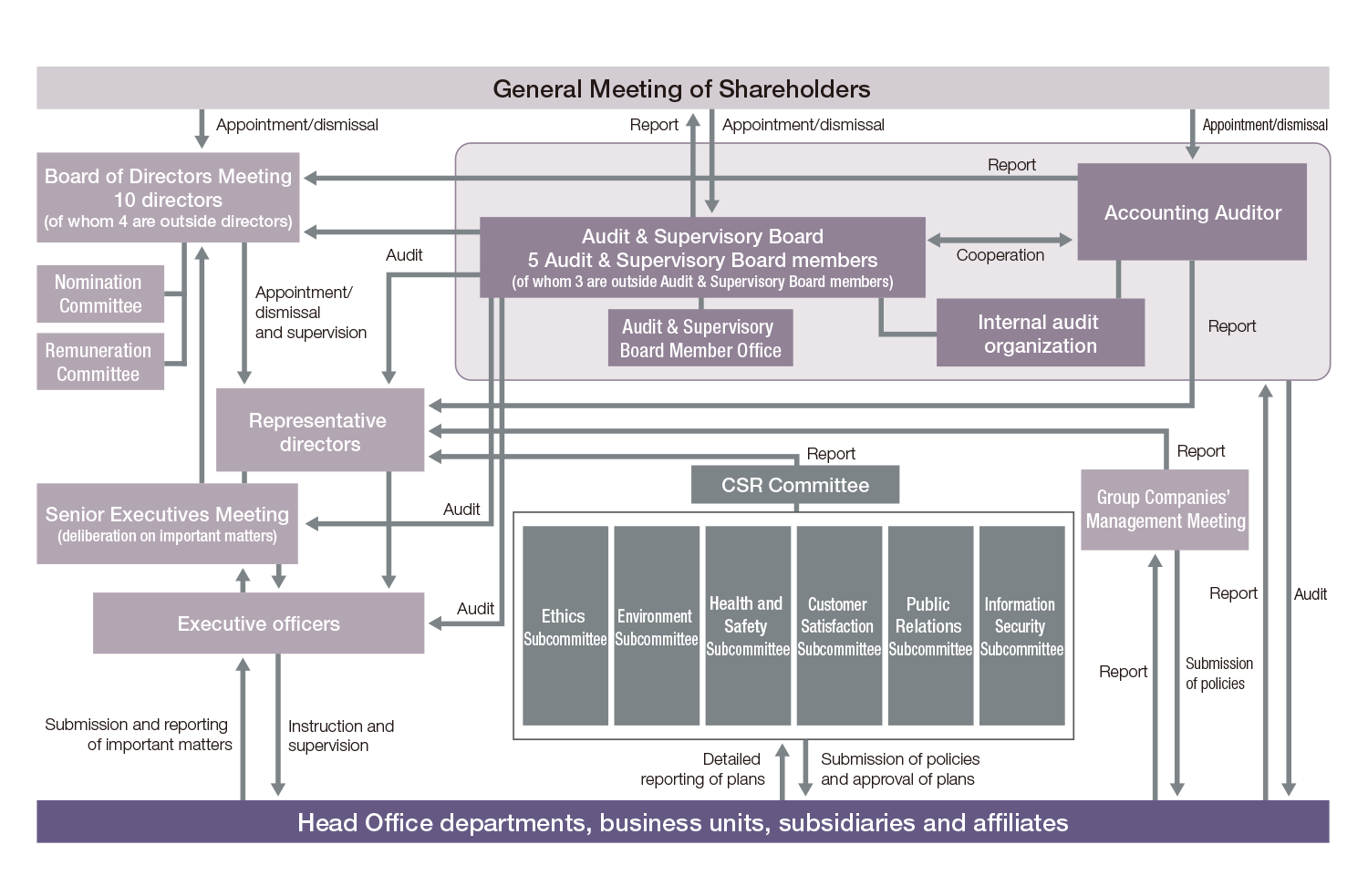

Corporate Governance Structure

As a company with an Audit & Supervisory Board, Rengo is making efforts to enhance its management transparency and strengthen its supervision of management. Our Audit & Supervisory Board, our internal audit organization, and other related bodies work together to secure audit schedules and audit structures, as well as appropriate auditing by the external Accounting Auditor. Audit & Supervisory Board members monitor the directors’ performance of duties and the operations, as well as the business and financial conditions of Rengo and its subsidiaries.

In addition to the Board of Directors Meetings, as a general rule, Senior Executives Meetings, Internal Officers Meetings (attended by full-time officers), Department Liaison Meetings, and other meetings are held at least once per month to make decisions promptly and share important information, thereby performing duties in an efficient manner.

Corporate Governance Structure (As of June 27, 2025)

History of Governance

- 1. Introduction of an Executive Officer System

Rengo introduced an executive officer system in April 2007 to strengthen the decision-making, supervisory, and business execution functions of the management. - 2. Reduction in the Number of Directors

At the Ordinary General Meeting of Shareholders held in June 2007, the Articles of Incorporation was amended to reduce the maximum number of directors from 24 to 18. The number of directors appointed at the meeting decreased to 15. The total number of directors as of the conclusion of the Ordinary General Meeting of Shareholders held in June 2025 is 10. - 3. Appointment of Outside Directors

Rengo has conventionally appointed outside directors, and has taken the following actions in response to the establishment of the Corporate Governance Code.

1. Appointed two independent outside directors at the Ordinary General Meeting of Shareholders held in June 2017

2. Appointed three independent outside directors at the Ordinary General Meeting of Shareholders held in June 2020

3. Appointed four independent outside directors at the Ordinary General Meeting of Shareholders held in June 2021*

*A total of 10 directors were appointed at the meeting referred to in above 3. Outside directors have come to account for one-third or more of the Board of Directors, and the diversity of the Board increased with the appointment of one female outside director. - 4. Evaluation and Disclosure of the Effectiveness of the Board of Directors

Rengo disclosed an overview of the questionnaire-style evaluation of effectiveness in the Corporate Governance Report filed on June 30, 2017. The evaluation is carried out every year since then. - 5. Abolition of Takeover Defense Measures

Due to the expiration of the effective period, takeover defense measures were abolished at the conclusion of the Ordinary General Meeting of Shareholders held in June 2019. - 6. Adoption of Independent Consultation Committees

Effective December 17, 2019, we established a Nomination Committee and a Remuneration Committee as voluntary consultation bodies for the Board of Directors. The committees deliberate on matters consulted by the Board.

*The committees are chaired by an outside director. - 7. Disclosure of Skills Matrix

Rengo started to disclose skills matrix of director candidates in the notice of the Ordinary General Meeting of Shareholders held in June 2022.

Overview of Meeting Bodies and Committees

| Board of Directors Meeting |

To achieve a sustainable growth and improve medium- to long-term corporate value, the Board of Directors strives to ensure the effectiveness of its business execution and supervisory functions from an objective standpoint, taking into account the fiduciary duties and accountability to shareholders and attaching importance to the roles of independent outside directors. |

| Senior Executives Meeting |

Senior Executives Meetings are attended by the chairman & CEO, the president & COO, and executive officers who are at the managing executive officer level or higher and have been appointed as members of the meeting. In principle, meetings are held at least once a month to discuss and resolve matters to be submitted to the Board of Directors, important matters concerning the performance of duties, and important matters to be approved, among other matters. |

Nomination |

The Nomination Committee meets regularly and deliberates on such matters as the appointment and dismissal of directors, in response to consultation by the Board of Directors. The committee consists of six members: four outside directors, the chairman & CEO, and the president & COO. An outside director chairs the committee. |

| Remuneration Committee |

The Remuneration Committee meets regularly and deliberates on such matters as remuneration for directors and other officers, in response to consultation by the Board of Directors. The committee consists of six members: four outside directors, the chairman & CEO, and the president & COO. An outside director chairs the committee. |

| Group Companies’ Management Meeting |

Group Companies’ Management Meetings are held regularly, attended by Rengo's officers, including the chairman & CEO and the president & COO, and representatives from Rengo Group companies. The meeting thus ensures that important managerial matters and risk management measures are shared across the Group. |

Appointment Process of Directors and Audit & Supervisory Board Members

In nominating candidates for directors and Audit & Supervisory Board members, Rengo nominates persons who have a wealth of experience, high levels of insight and expertise conducive to effective corporate governance, sustainable growth, and medium- to long-term corporate value improvement. The Nomination Committee, a consultation body for the Board of Directors, deliberates on the nomination before the Board thoroughly deliberates on the matter and nominates the candidates. Candidates for Audit & Supervisory Board members are nominated with the consent of the Audit & Supervisory Board.

Matters Deliberated by the Board of Directors

Rengo's Board of Directors hold not only regular meetings but extraordinary meetings as necessary. The Board makes decisions on matters stipulated by laws and regulations and important managerial matters, as well as constantly supervises the status of business execution.

In FY3/2025, nine regular Board of Directors Meetings were held, where the Board deliberated on 43 items to be resolved or approved and 38 items reported.

At the Board of Directors Meetings, outside directors and outside Audit & Supervisory Board members have made suggestions to further enhance the Board functions. Steady efforts are underway for the enhancement.

Skills Matrix

The skills matrix below outlines Rengo's expectations by field for directors based on their knowledge, experience, and abilities.

| Name | Position in the company |

Outside | Corporate management |

Sales & marketing |

Finance & accounting |

Governance | Sustainability | Global | Nomination Committee |

Remuneration Committee |

| Kiyoshi Otsubo | Representative Director Chairman & CEO |

● | ● | ● | ○ | ○ | ||||

| Yosuke Kawamoto | Representative Director President & COO |

● | ● | ● | ○ | ○ | ||||

| Hiromi Sambe | Member of the Board Executive Vice President |

● | ● | |||||||

| Ichiro Hasegawa | Member of the Board Executive Vice President |

● | ● | |||||||

| Hirofumi Hori | Member of the Board Executive Vice President |

● | ● | |||||||

| Sadatoshi Inoue | Member of the Board Executive Vice President |

● | ● | |||||||

| Yoshio Sato | Member of the Board | ○ | ● | ● | ○ | ○ | ||||

| Masayuki Oku | Member of the Board | ○ | ● | ● | ○ (Chair) |

○ (Chair) |

||||

| Kaoru Tamaoka | Member of the Board | ○ | ● | ● | ○ | ○ | ||||

| Koichi Sumida | Member of the Board | ○ | ● | ● | ○ | ○ |

Evaluating the Effectiveness of the Board of Directors

Regarding the effectiveness of the Board of Directors, Rengo works to enhance the functions of the Board by conducting an annual questionnaire survey (self-evaluation) of directors and Audit & Supervisory Board members including outside officers followed by the report and discussion about the results of its analysis at a Board of Directors Meeting.

Based on the results of the FY3/2025 questionnaire survey, it was confirmed that the overall effectiveness of the Board is being maintained. Directors and Audit & Supervisory Board members have provided constructive input and suggestions regarding improvements to the composition, roles, and operation of the Board, and have shared issues facing the Board.

Discussions and efforts are underway to put these input and suggestions into practice.

We will continue to work to enhance the functions of the Board by regularly analyzing and evaluating its effectiveness.

Ensuring the Expertise, Independence, and Diversity of the Board of Directors

As of June 27, 2025, the Company forms its Board of Directors with 10 members. In nominating directors, we comprehensively evaluates candidates’ experience, knowledge, and expertise and makes holistic decisions. To ensure the effectiveness of supervision and practical discussions among the directors, we nominate directors with an eye towards the overall balance and diversity of the Board of Directors.

Furthermore, Rengo has appointed four independent outside directors, thus allowing for opinions stated from an independent stance during discussions at the Board of Directors Meetings. In addition to meeting the criteria for outside directors in accordance with the Companies Act and satisfying the qualifications for independent directors/auditors with no potential conflicts of interest with ordinary shareholders stipulated by the Tokyo Stock Exchange, candidates who can contribute to sustainable growth and increasing corporate value over the medium- to long-term are selected as outside directors.

One of our 10 directors is a female outside director. With this appointment, outside directors now account for one-third or more of the Board of Directors and the diversity of its membership has also been ensured.

Three outside Audit & Supervisory Board members have been appointed, and they will fulfill their roles and duties independently, making full use of their high-level of specialist knowledge and broad experience, as well as offering an appropriate level of input at the Board of Directors Meetings.

Activities of the Nomination Committee and the Remuneration Committee

Rengo has established a Nomination Committee and a Remuneration Committee as voluntary consultation bodies for the Board of Directors. Each of these committees consists of three or more directors appointed through the Board’s resolution, a majority of whom are outside directors, and the position of chair in each committee is held by an outside director.

To strengthen the independence, objectivity, and accountability of the Board functions with appropriate engagement of and advice from outside directors, the Nomination Committee and the Remuneration Committee meet regularly and deliberate on matters such as the appointment and dismissal of directors and other officers and remuneration of them respectively, in response to consultation by the Board.

Remuneration for Officers

Rengo has adopted a remuneration system for officers that is linked to medium- to long-term performance in order to provide healthy incentives for achieving sustainable growth. We also provide stock compensation, appropriately set the ratio of cash remuneration to stock compensation, and have a shareholders’ association made up of officers so that the company is managed with an eye towards increasing corporate value.

The amount of remuneration for directors is determined within the scope of the total amount of remuneration (including the amount of remuneration based on the stock compensation plan) approved by the General Meeting of Shareholders. In determining the remuneration level, consideration is given to social trends in director remuneration, our business performance, balance with employee salaries, and other matters that should be taken into account. Directors’ remuneration consists of basic remuneration, performance-based remuneration (bonuses), and non-monetary remuneration (stock compensation). To ensure the independence and other points of view, remuneration for outside directors consists solely of basic remuneration.

Basic remuneration is paid monthly as fixed monetary remuneration. The amount is determined in accordance with the rank of executive officers as which the recipients serve concurrently.

Performance-based remuneration is paid in the form of monetary bonuses. The amount is determined in accordance with the rank of executive officers as which the recipients serve concurrently, with consideration given to business performance for the fiscal year (mainly operating income and ordinary income) and with other factors. If the company decides to pay performance-based remuneration, the payment is made at a certain timing after the end of the relevant fiscal year.

Stock compensation in the form of board benefit trust constitutes non-monetary remuneration. The number of shares granted is equivalent to the number of points given in accordance with the rank of executive officers as which the recipients serve concurrently, and is set within the scope of the upper limit of cash contributed by the company and the maximum number of points given to eligible directors, which have been approved by the General Meeting of Shareholders. Shares are granted to eligible directors at a certain timing after their retirement (after their retirement as executive officers if they continue to serve as executive officers).

The details of remuneration for individual directors are determined by resolution of the Board of Directors, after deliberation by the Remuneration Committee, a consultation body for the Board.

Cross-Shareholdings

To build and strengthen stable, long-term relationships with business partners, Rengo may acquire and hold their shares if doing so is considered conducive to the company’s sustainable growth and medium- to long-term corporate value improvement. All cross-shareholdings are reviewed in terms of effectiveness, such as medium- to long-term economic rationality and contribution to the maintenance and strengthening of comprehensive relationships with business partners. The outcome of the review is reported to the Board of Directors, and the status of the holdings along with the verified purposes for holding them are disclosed in the securities report. We consider reducing cross-shareholdings that are found, in the review process, to have lost significance, after examining whether the risks and benefits of holding the shares are worth the cost of shareholder’s equity.

Succession Planning

Rengo proactively engages in succession planning for the CEO and other officers by appointing and nominating senior executives and directors at the Board of Directors Meetings. We provide appropriate supervision so that sufficient time and resources are invested systematically in the development of successor candidates.