TCFD Disclosure / FY2022

The Rengo Group recognizes that the evaluation of impact related to risks and opportunities arising from climate change as well as the proposal and promotion of countermeasures are essential for realizing a sustainable society and enhancing business sustainability. In December 2021, we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Following the disclosure of information in accordance with the recommendations of TCFD in FY2022, scenario analysis was conducted for the paperboard and packaging-related business, our main business. Rengo considers climate change countermeasures as important management issues. We will promote reductions in greenhouse gas emissions and provide information based on the TCFD recommendations to help create a decarbonized society.

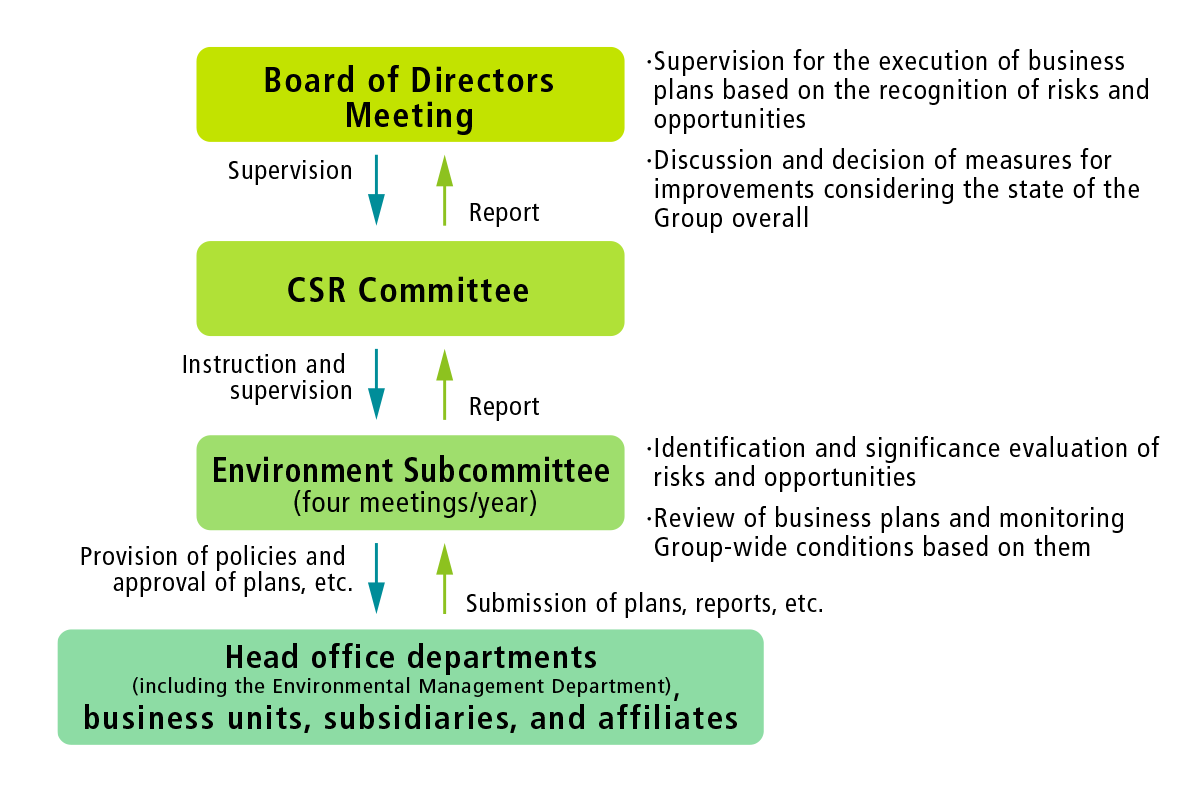

Rengo has established a CSR Committee chaired by the Chairman & CEO with the aims of improving management quality and reducing and avoiding future risks. Under this CSR Committee, an Environment Subcommittee chaired by the senior managing executive officer in charge of environmental management has been established to promote environmental management. The Environmental Management Department serves as the secretariat for the Subcommittee. In Environment Subcommittee meetings, which are held four times in a year, the current state of achievement for environmental targets, state of legal compliance, and progress of TCFD disclosure are checked Group-wide, and discussions and decisions are made on items such as company-wide directions, targets, and plans related to the environment, including climate change countermeasures. The results are reported to the CSR Committee.

Depending on the significance and urgency, cases reported to the CSR Committee are used to develop an effective system for monitoring and guiding environmental management, including collaboration with the Board of Directors as necessary.

The Environment Subcommittee also understands risks related to water necessary for paperboard manufacturing process as well as other major risks by associating them broadly with climate change, and promotes countermeasures against these risks.

The following have been established as subordinate organizations of the Environment Subcommittee.

After taking into consideration important environmental aspects and other matters such as environmental laws and regulations, Rengo identifies risks and opportunities in its business plans involving the promotion of environmental management through deliberation at the Environmental Subcommittee.

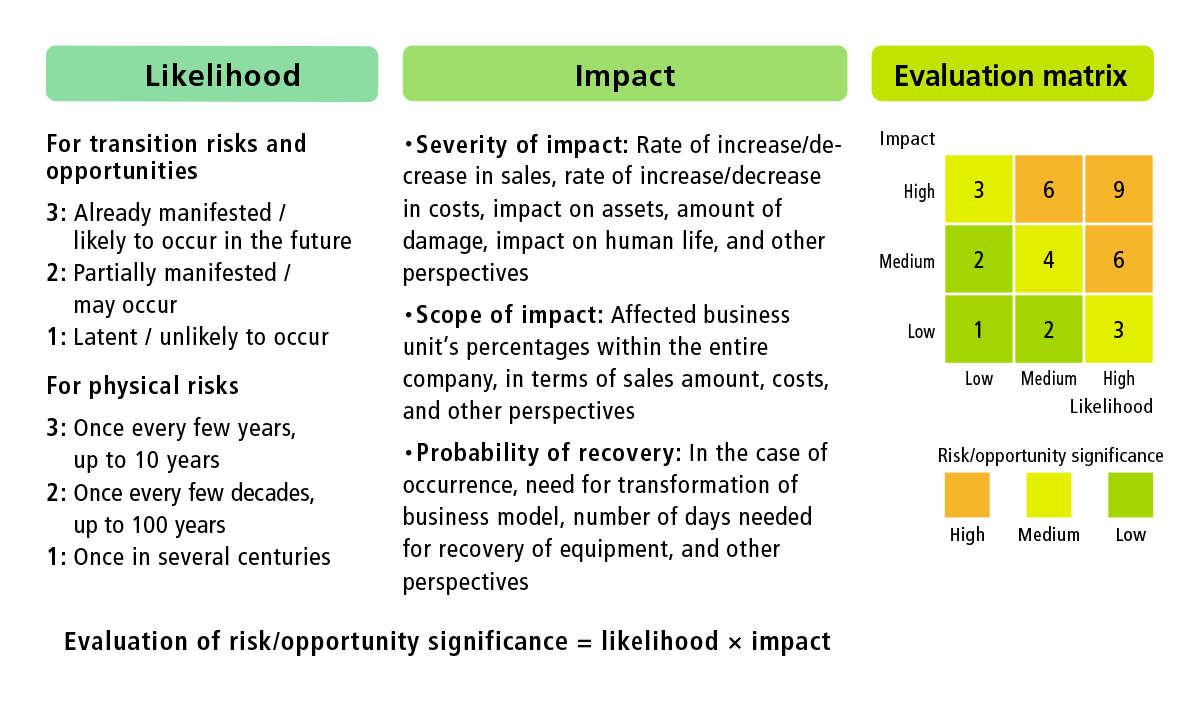

The Environmental Subcommittee and CSR Committee evaluates the likelihood and impact after identifying risks and opportunities. They also prioritize initiatives, keeping in mind the timeline of immediate and medium-to-long term responses. Then, they examine business plans aimed at mitigating, transferring, or controlling risks, and increasing opportunities or converting risks into opportunities. They also direct matters—such as the formulation of internal regulations and preparation of manuals—and monitor the overall Group situation.

The Board of Directors supervises the execution of business plans involving environmental management based on a recognition of the identified risks and opportunities. At the same time, the Board deliberates and makes decisions on improvement initiatives and other matters as necessary while taking into consideration the overall Group situation.

From the achievement of environmental targets—such as Eco Challenge 2030—to the substantiation of our strategic framework for countermeasures contributing to value creation and loss avoidance for the Rengo Group and our stakeholders, our business units and Group companies operate according to the recognition of these risks and opportunities. The Environmental Management Department coordinates and guides these operations, and proposes education for frontline human resources and support plans such as those for subsidizing the attainment of qualifications. The department also carries out monitoring, measurement, analysis, and evaluation of operation and performance—including emergency responses and periodic training—as well as audits to ensure their effectiveness.

We identify opportunities for improvement in their performance and implement measures that lead to subsequent performance improvement. At the same time, we strive to enhance resilience against climate change by continuing to monitor the effects.

Regarding our management system for these efforts, our top management is involved in general and directs continuous improvement of environmental performance so as to ensure its effectiveness as one of our Group-wide management systems.

Environment Subcommittee

- Composition:

- President, Chairman*1, Vice Chairman*2, committee members*3, and observers*4

*1 Executive officer in charge of the Environmental Management Department

*2 Executive officer in charge of the Finance and Accounting Group

*3 Designated general managers of the following organizations: Marketing Strategy Group, Administration Group, Production Group, Engineering Development Group, and Business Development Group in the Packaging Business Unit; Production Group and Engineering Development Group in the Paperboard Business Unit; Procurement Unit; Central Laboratory in the R&D and Environmental Management Unit; Finance & Accounting Group; Domestic Affiliated-Company Administration Group; Overseas Business Group; Information Systems Group; Corporate Planning Department; Compliance Promotion Office; and General Affairs Department, as well as General Manager of Yashio Mill, Paperboard Business Unit

*4 Full-time Audit & Supervisory Board Members, general manager of the Public Relations Department, and members of the Environment Subcommittee in each Group company - Meeting frequency:

- Four times/year

- Topics:

- ・Checking the progress toward environmental targets and state of legal compliance

・Discussion and decision of climate change countermeasures and other directions for Rengo

・Identification of risks and opportunities, and evaluation of their likelihood and impact

The Rengo Group is working to achieve net zero greenhouse gas emissions, stating the Rengo Group Environment Action 2050 as our long-term targets for 2050. In April 2021, we formulated CO2 emission reduction targets for our Group companies in Japan under Eco Challenge 2030, our medium-term targets for FY2030. Starting from January 2023, we are also expanding the scope, covering Group companies in Japan and overseas for Scope 1, Scope 2, and Scope 3, as part of target setting toward obtaining science-based targets (SBT) approval. To achieve these targets, we engage in the reduction of greenhouse gas emissions by formulating greenhouse gas emission reduction roadmaps at the Decarbonization Working Group and managing the progress of efforts such as promotion of energy saving and conversion to renewable energy.

| Rengo Group (consolidated companies) |

|

| Japan (companies subject to the Act on the Rational Use of Energy) |

|

| Trend of Scopes 1 and 2 Emissions* | (Thousand t-CO2) |

| FY2017 | FY2018 | FY2019 | FY2020 | FY2021 | |||

|---|---|---|---|---|---|---|---|

| Scope 1 emissions |

Non-consolidated | 613 | 674 | 663 | 637 | 671 | |

| Domestic consolidated subsidiaries |

Paperboard mills | 152 | 150 | 158 | 150 | 221 | |

| Others | 69 | 69 | 74 | 98 | 102 | ||

| Overseas consolidated subsidiaries |

17 | 16 | 15 | 12 | 14 | ||

| Total | 851 | 908 | 910 | 898 | 1,008 | ||

| Scope 2 emissions |

Non-consolidated | 197 | 173 | 166 | 151 | 162 | |

| Domestic consolidated subsidiaries |

Paperboard mills | 64 | 64 | 61 | 40 | 51 | |

| Others | 88 | 103 | 96 | 110 | 115 | ||

| Overseas consolidated subsidiaries |

18 | 16 | 16 | 16 | 22 | ||

| Total | 368 | 356 | 338 | 317 | 351 | ||

| Scope 1 and 2 emissions |

Non-consolidated | 810 | 847 | 829 | 788 | 834 | |

| Domestic consolidated subsidiaries |

Paperboard mills | 216 | 214 | 219 | 191 | 272 | |

| Others | 158 | 172 | 170 | 209 | 217 | ||

| Overseas consolidated subsidiaries |

35 | 32 | 31 | 28 | 36 | ||

| Total | 1,218 | 1,265 | 1,248 | 1,215 | 1,359 | ||

| Trend of Scope 3 Emissions* | (Thousand t-CO2) |

| FY 2017 |

FY 2018 |

FY 2019 |

FY 2020 |

FY 2021 |

Main emission sources | |||

|---|---|---|---|---|---|---|---|---|

| Scope 3 emissions |

Category 1 |

Purchased goods and services |

638 | 630 | 663 | 660 | 637 | Procurement of raw materials at production plants |

| Category 2 | Capital goods | 56 | 33 | 45 | 45 | 56 | Purchase of fixed assets | |

| Category 3 | Fuel- and energy-related activities not included in Scope 1 or Scope 2 |

107 | 106 | 144 | 139 | 156 | Purchase of electricity and fuel | |

| Category 4 | Upstream transportation and distribution |

99 | 101 | 92 | 88 | 97 | Transportation from primary suppliers to procure raw materials and transportation of products for sale |

|

| Category 5 | Waste generated in operations |

4 | 4 | 4 | 4 | 4 | Transportation and processing of waste discharged by plants (incineration, landfill) |

|

| Category 6 | Business travel | 3 | 3 | 1 | 1 | 1 | Transportation by bullet train or plane and lodging |

|

| Category 7 | Employee commuting | 4 | 4 | 8 | 7 | 5 | Commuting via private car or train |

|

| Category 8 | Upstream leased assets | 1 | 1 | 1 | 1 | 1 | Server use at data centers | |

| Category 9 | Downstream transportation and distribution |

Outside the scope of calculations | ― | |||||

| Category 10 | Processing of sold products |

102 | 100 | 83 | 80 | 124 | Corrugated packaging processing at linerboard/corrugating medium customers and film processing at film customers |

|

| Category 11 | Use of sold products |

19 | 11 | 12 | 10 | 10 | Use of packaging machinery by customers |

|

| Category 12 | End-of-life treatment of sold products |

17 | 16 | 21 | 18 | 15 | Disposal of sold linerboard / |

|

| Category 13 | Downstream leased assets |

Calculated by inclusion in Category 11 (Use of sold products) |

― | |||||

| Category 14 | Franchises | Outside the scope of calculations | ― | |||||

| Category 15 | Investments | Outside the scope of calculations | ― | |||||

| Total | 1,051 | 1,010 | 1,072 | 1,052 | 1,104 | |||

*Non-consolidated

The Rengo Group undertakes scenario analysis to understand the business impact of climate change and evaluate the resilience of strategies for climate-related risks and opportunities.

In FY2022, we carried out scenario analysis for the risks and opportunities disclosed in May 2022 in accordance with the framework recommended by TCFD, focusing on the paperboard and packaging-related business, our main business. Analysis was conducted for the short term (in one to three years’ time), medium term (for the year 2030), and long term (for the year 2050) and based on our prediction of the external environment in 2030.

For the scenarios, we adopted a 1.5°C scenario for transition toward a low-carbon economy based on the Paris Agreement as well as a 4°C scenario in which there are no climate change countermeasures taken beyond those currently expected. In the 1.5°C scenario, in addition to the strengthening of climate change countermeasures such as the introduction of a carbon tax, we assumed the occurrence of physical impact from climate change caused by the rise in average temperatures. In the 4°C scenario, we assumed that climate change countermeasures are similar to those of the reporting year (FY2023) even though there is the occurrence of physical impact from climate change, including torrential rains and severe typhoons.

In FY2022, after repeated discussions such as through workshops that spanned business units, we narrowed down the risks and opportunities arising from climate change, understood the expected financial impact, and examined countermeasures.

As a result, while we also confirmed the possibility of impact in both aspects of risks and opportunities for the 4°C scenario, we reached the recognition that, in the 1.5°C scenario where there is progress in the transition toward a low-carbon society, there is a high possibility of greater impact in the transition risks and opportunities. The Rengo Group promotes environmental management with consideration for the risks and opportunities in each scenario.

| 4°C scenario | 1.5°C scenario |

|---|---|

| Scenario with the maximum emissions, with development reliant on fossil fuels and climate policies are not implemented | Scenario where temperature rise is limited to 1.5°C through sustainable development |

| Either IPCC SSP5-8.5 (temperature rise of 3.3-5.7°C) or SSP3-7.9 (temperature rise of 2.8-4.6°C) IEA Stated Policies Scenario (STEPS) |

IPCC SSP1-1.9 (temperature rise of 1.0-1.8°C) IEA Net Zero Emission by 2050 Scenario (NZE) |

| Type of risk | Risks/ opportunities |

Impact on business continuity and profits* |

||

|---|---|---|---|---|

| 4°C scenario |

1.5°C scenario |

|||

| Transition risks |

Policy and legal regulations | Introducing and enhancing carbon tax | Low | High |

| Further tightening of regulations for plant equipment | Low | High | ||

| Market risks | Rise in retail price of electricity | Low | High | |

| Natural gas price volatility | High | Low | ||

| Tight supply and demand for recovered paper | Medium | High | ||

| Opportuni ties |

Market opportunities |

Rising demands from financial market and stakeholders for climate change countermeasures and information disclosure | Medium | High |

| Products and services |

Development of leading-edge low-carbon technologies and expansion in demand for low CFP | Low | High | |

| Improvement in resource efficiency | CO2 reduction in logistics and improvement in logistics efficiency | Medium | High | |

| Physical risks |

Acute | Such as impact on facilities from higher intensity and frequency of disasters (torrential rains, floods, and storm surges) | High | High |

* The evaluation criteria for impact are given below.

| Risks/opportunities | Countermeasures |

|---|---|

| Introduction and enhancing of carbon tax (carbon pricing), etc. Tightening of GHG emission regulations |

|

| (Significance evaluation)

・Likelihood (1.5°C scenario): High ・Impact (same as above): High |

In the 1.5°C scenario, amid tightening of regulations as climate change countermeasures, there is a high probability of environmental tax burden such as carbon tax or wider adoption of carbon pricing due to the expansion of emission rights trading. As it requires the Rengo Group to take countermeasures, the financial impact on the Group is expected to be significant As of the analysis for 2030, the financial impact from the introduction of a carbon tax under the 1.5°C scenario is estimated to be 8.2 billion yen.

| Estimation of financial impact in 2030 | ||

|---|---|---|

| Introduction of carbon tax |

-8.2 billion yen |

|

As the movement toward a decarbonized society accelerates globally, environmental regulations are being tightened and demands for company responses are continually expanding. Taking this situation into consideration, Rengo seeks risk avoidance (such as mitigation, transfer, and control) from the medium- to long-term perspective through capital investments for energy conversion and advancement of low-carbon efforts via cooperation with suppliers. In addition, if there is a significant increase in the probability of financial impact beyond the scope of CO2 emission reduction efforts, or if there is financial impact—such as from the purchase of carbon credits—that requires an immediate response, the Rengo Group will take risk mitigation measures by achieving fair product prices to minimize such impact.

| Risks/opportunities | Countermeasures |

|---|---|

| Electricity retail price increase |

|

| (Significance evaluation) ・Likelihood (1.5°C scenario): High ・Impact (same as above): High |

In the 1.5°C scenario, there is a high chance of increase in the cost of purchased electricity due to the spread of renewable energy in electricity supply and other changes in the composition of electricity sources, which may have significant financial impact on the Rengo Group

Taking into consideration the characteristics of electric energy, for which keeping the balance equilibrium between supply and demand and securing the quality is difficult, Rengo seeks to control risk associated with price fluctuations by per-unit improvement through efficient use of electric energy and by leveling operation and procurement.

In addition, as an immediate response, we seek to mitigate risk by setting fair product prices that minimize the impact of price increases and volatility.

In the medium-to-long term, we aim to mitigate or transfer the risk of price fluctuations through efforts such as the installation of renewable energy generators or boilers in paper mills and other sites or the use of PPA models. We will also pursue risk avoidance by progressively shifting the composition of our electricity sources.

| Risks/opportunities | Countermeasures |

|---|---|

| Natural gas price volatility |

|

| (Significance evaluation) ・Likelihood (4°C scenario: Medium ・Impact (same as above): High |

In the 4°C scenario, the financial impact on the Group is expected to be significant, either due to an increase in natural gas prices linked to higher oil prices, or due to upward pressure on prices from expansion in gas demand arising from the transition to energy with lower greenhouse gas emissions, carbon divestment, and other reasons.

In the Rengo Group, natural gas is a core energy source with high usage. Therefore, we seek to control risk by per-unit improvement through the promotion of energy saving. As an immediate response, we also seek to mitigate risk by setting fair product prices that minimize the impact of price increases and fluctuations while signing long-term contracts and taking other measures to maintain stable procurement in both aspects of price and volume.

In the medium-to-long term, based on the assumption of continued stable procurement, we also seek risk avoidance by converting from natural gas to renewable energy that does not emit CO2 and has a relatively smaller impact of price volatility .

| Risks/opportunities | Countermeasures |

|---|---|

| Tight supply and demand for recovered paper |

|

| (Significance evaluation) ・Likelihood (1.5°C scenario): Medium ・Impact (same as above): High |

In the 1.5°C scenario, based on the advantages of logging control and energy use reduction, we also expect further increase in procurement costs due to the tight supply and demand for recovered paper, such as replacing virgin pulp with recovered paper. As the Rengo Group uses large amounts of recovered paper, an increase in the price of recovered paper, if any, will have a significant financial impact on the group.

As the main raw material, large amounts of recovered paper are used in paperboard business. Therefore, we seek to mitigate risk by achieving fair product prices that minimize the impact of price increases and volatility.

In the medium-to-long term, we strive to control risk by establishing a supply chain that constantly moves toward optimization of inventory levels based on a common understanding with suppliers that the leveling of recovered paper price volatility enhances mutual sustainability.

| Risks/opportunities | Countermeasures |

|---|---|

| Rising demands from financial market and stakeholders for climate change countermeasures and information disclosure |

|

| (Significance evaluation) ・Likelihood (1.5°C scenario): Medium ・Impact (same as above): High |

In the 1.5°C scenario, there is greater emphasis on the ways that companies recognize and respond to the risks and opportunities arising from climate change, and we expect our actions to also be reflected in our corporate valuation and credit rating.

Besides the negative aspect of risks arising from climate change issues, the Rengo Group also emphasizes the aspect of opportunities that lead to Increasing competitiveness through strengthening countermeasures against such issues. We strive to improve the quality and quantity of sustainability disclosure from a medium- to long-term perspective by expanding and deepening the disclosure of information related to specific details and forecasts for our series of initiatives.

| Risks/opportunities | Countermeasures |

|---|---|

| Development of leading-edge low-carbon technologies Expansion in demand for low CFP |

|

| (Significance evaluation) ・Likelihood (1.5°C scenario): Medium ・Impact (same as above): High |

A majority of the raw materials for the Rengo Group's paperboard and corrugated packaging is founded on resource circulation through recycling. We have also improved our advantage in reducing per-unit CO2 emissions through pioneering initiatives in energy saving in our manufacturing processes. We continue to strive for further per-unit CO2 reductions, and in the 1.5°C scenario, we recognize that there are greater expectations on our Group's response capabilities than before due to further requirements for low-carbon efforts.

In the medium-to-long term, we will comprehensively carry out analysis of emissions, amount of resource use, and other aspects of a product's life cycle (analysis of life cycle inventory, or LCI) and life cycle assessment (LCA) that includes the assessment of their environmental impact (life cycle impact assessment, or LCIA) to strategically promote low-carbon efforts that also include cooperation with suppliers. These are based on the recognition that responding to low-carbon needs helps to improve our competitive advantage. In addition, we will seek to increase market opportunities by disclosing the progress of our low-carbon achievements based on the series of analyses and assessments and promoting our environmental advantage.

| Risks/opportunities | Countermeasures |

|---|---|

| CO2 reduction in logistics and improvement in logistics efficiency Integrated promotion of logistics efficiency |

|

| (Significance evaluation) ・Likelihood (1.5°C scenario): High ・Impact (same as above): Medium |

The Rengo Group, which is also engaged in the transportation business, the area with the most amount of greenhouse gas emissions after our industrial business units, recognizes the necessity for reducing environmental burden in logistics. In the 1.5°C scenario, besides greater requirements for logistics efficiency improvement, we also recognize that there is a high chance that policy incentives or regulations will be strengthened.

The Rengo Group— mainly divisions which have received Green Management certification— practices low-carbon initiatives in transportation and freight handling, such as the promotion of fuel-efficient driving and adoption of green vehicles. In addition, we seek to mitigate risk through a modal shift to maritime transportation, consolidation of transportation network, and other measures.

We are also engaged in packaging design that further improves logistics efficiency, such as making packaging thinner and lightweight. In addition, the entire Rengo Group seeks better efficiency of packaging modules and unit loads, and we are looking to expand opportunities to access policy incentives

or market opportunities by promoting sophisticated green logistics.

| Risks/opportunities | Countermeasures |

|---|---|

| Greater investment for resilience in response to extreme weather conditions Recovery, etc. when affected by extreme weather disaster damage Increase in various expenditures (freight, insurance , etc.) due to extreme weather Decrease in sales and increase in inventories due to the damage caused by extreme weather disasters at customers |

|

| (Significance evaluation) ・Likelihood (4°C / 1.5°C scenarios): High ・Impact (same as above): Medium |

Among environmental risks, natural disasters and extreme weather have a high probability of causing tremendous asset damage or financial losses. It is necessary to constantly improve our capabilities to respond to the diversification and intensification of expected incidents.

The Rengo Group has the strength of being able to make up for the business interruption and disruption in damaged areas as we have established a network of corrugated plants throughout Japan. However, besides the diversification and intensification of incidents due to climate change, increasing interdependence with suppliers in the supply chain and a concentration of production and logistics load in urban areas of demand are vulnerabilities to these risks, and we recognize that it is essential to properly understand them and have countermeasures to mitigate their impact.

We formulate business continuity plans (BCP) to shorten the period or limit the impact over time of business interruption and disruption caused by disasters arising from extreme weather and fulfill our supply responsibility for products. At the same time, we also conduct training programs and work on developing and securing staff for responding to incidents and reopening business activities. Other efforts to ensure the effectiveness of our BCP include enhancing the safety of our backups for information and data (vital records) that are essential to conduct business activities. In addition, we identify and evaluate the risk of business interruption and disruption, and strengthen countermeasures in the hardware aspect with a focus on flood damage, as it has significant impact over time and for which disaster prevention and mitigation measures are effective. With the aim of enhancing our supply chain management, we also analyze and evaluate the dependencies and risks that we have on partners and suppliers, diversifying procurement as needed.